The Financial Life Cycle

Most financial planning resources focus on net worth - your assets and liabilities - to measure your finances and define goals. In fact, net worth is a critical measure. But we add a measure for financial independence to the mix. After all, that's your ultimate goal, right? You can have substantial net worth but if it doesn't generate a sufficient monthly income stream to cover your living expenses (and debt, if you have any) then you aren't financially independent. That is, you'll have to supplement the income from your net worth assets with salary income.

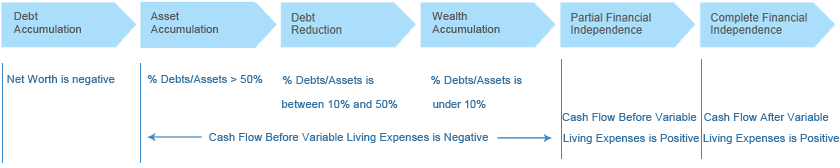

So in addition to the first 4 stages of the financial life cycle illustrated below - which are primarily defined by assets and liabilities - we add the Partial and Complete Financial Independence stages. These last two stages are defined by your Cash Flow.

For more information about the cashflownavigator™ Financial Life Cycle, and strategies to help you move more quickly through each stage, read our e-booklet "Wealth is Good, Cash Flow is Better."

We define the six stages of the Financial Life Cycle based on your Net Worth and Cash Flow.

You should strive to move through the early stages of the Life Cycle as quickly as possible, moving towards - and ultimately achieving - Complete Financial Independence.